𝐆𝐫𝐞𝐚𝐭𝐞𝐫 𝐓𝐨𝐫𝐨𝐧𝐭𝐨 𝐀𝐫𝐞𝐚 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬: 𝐍𝐨𝐯𝐞𝐦𝐛𝐞𝐫 𝟐𝟎𝟐𝟒 – 𝐖𝐡𝐚𝐭'𝐬 𝐍𝐞𝐱𝐭?

Tuesday Dec 10th, 2024

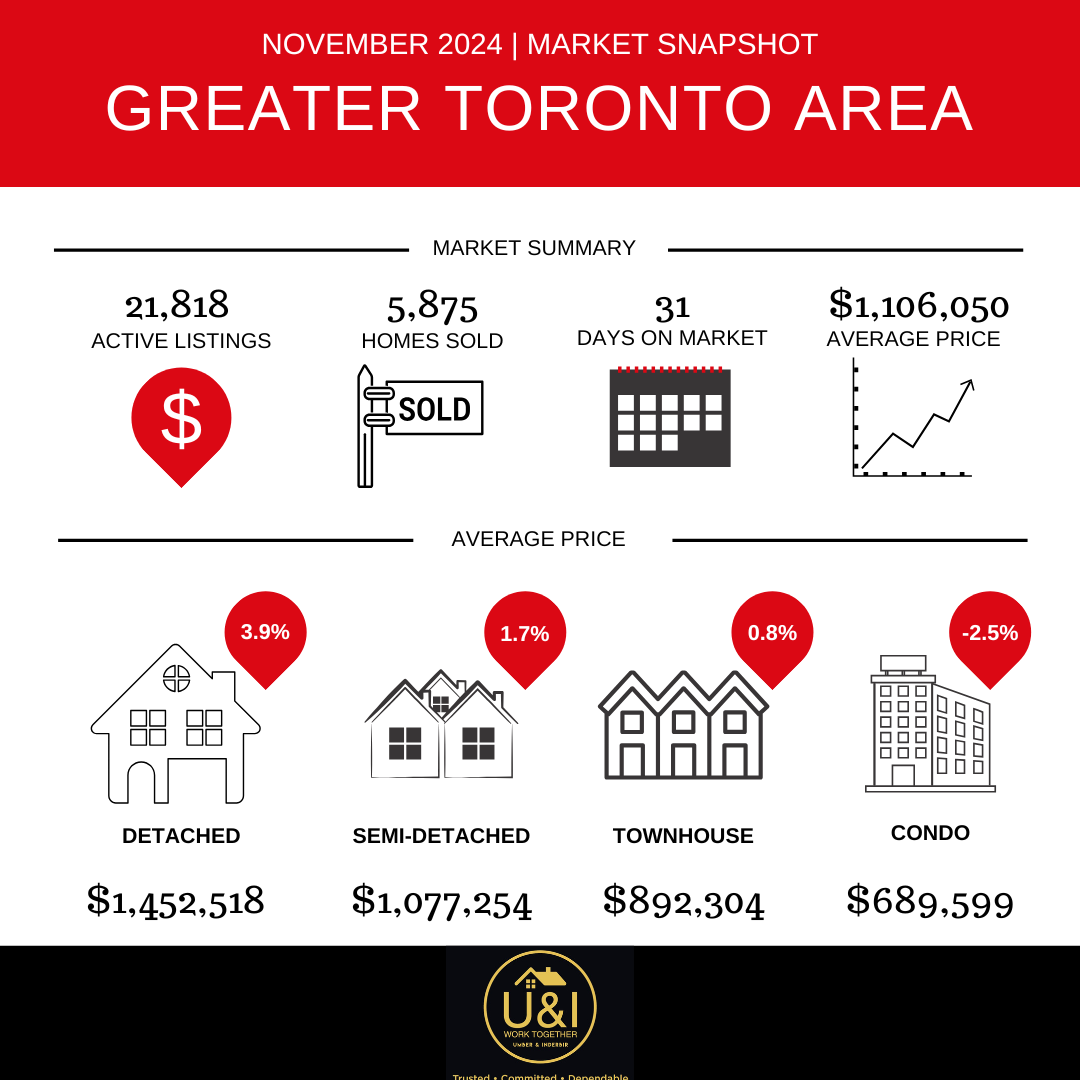

The November 2024 market snapshot for the Greater Toronto Area (GTA) paints a picture of a market in transition. With interest rates starting to decline, the dynamics of buying, selling, and investing in real estate are shifting. Lower borrowing costs could breathe new life into a market that has already shown resilience. Here’s my take on what these trends mean for you.

A Market Poised for Growth

The GTA saw 21,818 active listings and 5,875 homes sold in November, with homes spending an average of 31 days on the market. The average price of $1,106,050 across all property types reflects the enduring strength of this market.

But it’s the direction of interest rates that might truly shake things up. After months of high borrowing costs, the tide is finally turning. A drop in interest rates could bring new buyers into the market, reigniting demand across all property types.

Detached Homes: Still Leading the Charge

Detached homes continue to shine, with prices rising 3.9% to an average of $1,452,518. This upward trend reflects strong demand for spacious properties—a trend that could accelerate as lower interest rates make higher-priced homes more accessible.

Sellers, this is your moment to maximize your return. Buyers, while competition for detached homes will likely heat up, lower rates might just give you the edge you need to secure your dream property.

Condo Market: Set for a Comeback?

Condo prices dipped by 2.5% in November, bringing the average price to $689,599. However, with declining interest rates, this segment could be on the verge of a turnaround. Lower borrowing costs often benefit first-time buyers and investors—two groups that typically drive condo demand.

If you’re looking for a more affordable way to enter the market, now could be the perfect time to buy a condo before prices start to climb again. For investors, this dip presents an excellent opportunity to snag properties that will likely appreciate as rates drop further.

Semi-Detached and Townhomes: Stability with Potential

Semi-detached homes saw a 1.7% increase, while townhomes ticked up 0.8% in November. These property types remain reliable options for families and buyers seeking a balance between space and cost.

With interest rates declining, demand for these mid-tier properties could rise, pushing prices higher in the months ahead. Buyers looking for a solid investment should act soon before this segment heats up.

The Impact of Falling Interest Rates

The most significant factor shaping the GTA market is the declining interest rates. Here’s how this shift could impact the market:

- Increased Affordability: Lower mortgage rates mean buyers can afford higher-priced homes without increasing their monthly payments, likely driving demand for all property types.

- Renewed Buyer Confidence: With borrowing costs easing, many buyers who have been sitting on the sidelines may re-enter the market, adding momentum to sales activity.

- Upward Pressure on Prices: As demand increases, particularly in desirable areas or property types, we could see upward pressure on prices, especially for detached homes and townhouses.

What’s Next for the GTA Market?

As interest rates continue to decline, the GTA market is likely to become more competitive. Detached homes will remain highly sought-after, while condos and townhomes could see a resurgence as buyers take advantage of the improved affordability. Sellers should anticipate more interest, while buyers should act quickly to secure favorable deals before prices adjust to the increased demand.

My Advice

- Sellers: Take advantage of the growing demand. Price your property strategically to attract buyers and maximize your sale.

- Buyers: The time to act is now! Declining interest rates won’t last forever, and prices are likely to rise as demand picks up. Get pre-approved and start your search before competition intensifies.

- Investors: The current market conditions, particularly the dip in condo prices, offer a golden opportunity to buy at lower prices and benefit from future appreciation.

The GTA real estate market is on the cusp of change, driven by the tailwind of falling interest rates. Whether you’re buying, selling, or investing, there’s no better time to seize the opportunities ahead.

Ready to make your move? Let’s connect and make the numbers work for you!

Post a comment